Articles:

The Many Faces of GenAI and Fraud Detection in Financial Services

Companies need to integrate generative AI into their existing fraud detection capabilities, taking into account the following challenges, but the path is not easy. This article shares reasons why.

A Quick-Start Guide: Corporate Ventures in Financial Services and Fintech

CEO’s know that to achieve additional top-line growth, new lines of business need to be created; Corporate Venturing is one of the best ways to do this - this is how it works.

Scenario Planning and Generative AI in Financial Services

Businesses can improve their strategic resilience by thinking about, planning for, and preparing for multiple futures through the use of Scenario Planning.

5 Important Considerations for Fintech Companies Eyeing Global Expansion

Our experiences at Ulysses Partners have shown that there are 5 key considerations that fintech companies need to take into account when expanding into a new geographic market.

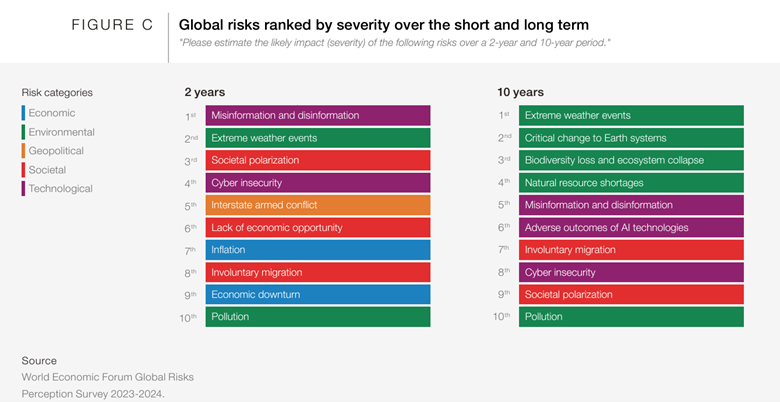

Special Edition: Reflections on the WEF Global Risk Outlook Report

Lead Risk and Compliance Partner, Avinash Singh, unpacks the latest from the 54th anniversary of the World Economic Forum in Davos. This year, the spotlight was on security, economic growth, AI's societal impact, and climate strategies.

Fintech Innovation: Redefining Impact Beyond Financial Services

The fintech industry, known for its groundbreaking solutions in financial services, is evolving in interesting new directions. This is a future where the transformative power of fintech is not confined only to financial transactions, but is a driving force for change and progress across the entire spectrum of business and society.

The EU AI Act's Influence on Financial Services and Fintech

The EU's Artificial Intelligence Act introduces a comprehensive framework for AI regulation, categorizing AI systems into risk levels with specific regulatory implications, aiming to balance risk management and innovation globally. This landmark legislation impacts various sectors, notably financial services, by enforcing transparency, data governance, and innovation within a regulated environment.

The Interconnected World of Climate Change and Financial Risks

Understand the complex linkage between environmental challenges and financial stability through recent regulatory developments.

Reimagining Fintech with Generative AI

The integration of generative artificial intelligence (AI) into the fintech sector is not just a futuristic concept but a present-day reality. This article explores ways generative AI is impacting the landscape - and potential challenges fintech face when leveraging its capabilities.

CFPB's Open Banking Proposal

Transforming financial data access in the US and lessons from other markets, with future expectations and key takeaways.

Is culture a leading indicator of risk-taking behavior in banks?

Recent insights underscore the need for a proactive way of identifying the potential risks in banks - and culture could be the indicator we need.

Has Fintech drifted from its promise to create impactful change?

It’s encouraging to see Fintech firms lifting their sleeves to take on some of the promises we’ve come to expect from them. Here are some examples sharing how they are making this happen.

Back to First Principles for a Tech-Driven Future

This week's Substack looks at how innovation, regulation, and a conscious bank-technology partnership strategy can spur growth and keep banks competitive.

Partnerships as a Financial Services Superpower

The power of 3rd party partnerships in unlocking value for financial services - whether in real estate, operations, or (our favorite topic) Embedded Finance.

Risky Business in Financial Services

How financial services innovation is challenged by macroeconomic factors, SEC regulation, and the hidden cost of working with technology vendors.

The Power of Sharing (or Not)

Global instant payment systems are rapidly transforming the financial services landscape. The Fed has taken live its FedNow Service, and there have successful pilots completed by Swift and leading banks - enabling 24/7 international transactions and end-to-end traceability.

AI, Automation, and LLMs

The Federal Reserve is introducing the FedNow® Service, an instant payment system in the U.S. that will allow individuals and businesses to send and receive payments within seconds, 24/7. By providing real-time settlement, the service aims to meet the demand for faster transactions and enhance accessibility, efficiency, and safety in the payment system.

How can we create an efficient lending process?

Jay Cherrie and David Milligan had an insightful discussion called: Taming the Boom and Bust Cycle of Lending with Process Automation.

Banking is Going Native.

A new report by Marqeta highlighted on Tearsheet shows the evolving landscape of financial services in the digital age. While the pandemic accelerated the adoption of digital banking, traditional banks still play a significant role, leading to the likelihood of a hybrid model for the future of banking.

How does Embedded Finance benefit end-customers?

Embedded Finance is the next 'step change' in financial services - the next evolution of fintech - which will solve more customer needs