Articles:

Identity Proofing and User Experience

Organizations looking into implementing identity proofing into their customer onboarding processes be sure to assess UX up-front, and make it a very heavily- weighted factor in the overall selection process – not an afterthought.

At the end of the day, organizations need to keep a clear focus on the ‘why’ when adding identity proofing to their customer acquisition journeys. It’s about enabling customers to sign up with them in a way that promotes trust – by proving their identity in the most definitive way – while making the process simple and intuitive.

Building Financial Services insight at large IT/technology providers

A rapidly evolving environment creates new challenges for FS and other large corporates - and new opportunities for the large technology & IT providers who traditionally serve them - if they can understand what's happening across the organization.

The problem is that in many large IT/technology providers, this kind of market insight is limited to a small pool of specialists, who are stretched thinly across the enterprise. A better approach is to build an understanding of the FS market and the trends shaping it across the organization via a well-designed set of training interventions.

Innovation in financial services: Ulysses Partners allies with Innovation 360

US financial institutions need to keep innovating around both products and channels to retain market share and find new revenue streams.

Specialist innovation management firm Innovation360 AB has allied with Ulysses Partners to help US banks accelerate their innovation agenda, drawing on a global database of innovation best practice from over 5,000 firms in 100 countries.

The Next Waves in US Banking - Part 3: Using BaaS to Issue Credit Cards

An area that can be particularly challenging for smaller banks is the issuance of credit cards, both consumer and business. Embedded finance has created new options in this area for smaller banks, allowing them to leverage what has been termed “Credit Cards as a Service” (CCaaS). This article, the 3rd and final in our series on Embedded Finance, gives an example of how this can work.

The Next Waves in US Banking - Part 2: Embedded Finance

This is the 2nd part of a short series of articles about Embedded Finance and how it is rapidly changing the US banking landscape. . This article expands on the themes from Part 1, showing in more detail the different layers (and players) that make embedded finance work in practice. Banks who embrace this can effectively “eat their cake and have it” - “it” being continued growth despite big changes in the competitive landscape in banking.

The Next Waves in US Banking - Part 1: Partner Banks Rising

More change is coming to banking in the United States. 2020 has seen an explosion in digital and online services across every industry, including financial services. But there are underlying trends in play that have the potential to shift the business models and competitive landscape of US banks fundamentally - including Partner Banking.

How Big Tech threatens banking

Big Tech firms can do a wide range of things that traditional banks find very difficult to do cost-effectively. Digital-only banks have had relatively limited success so far, partly because they have to build market reach incrementally, even when they are sponsored by a well-known commercial bank. Big Tech companies, like Google, Facebook, Amazon, Apple and Ant Group, have massive ready-made customer bases – both consumers and businesses – who are ripe for the digital finance picking.

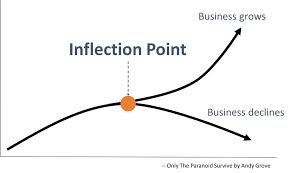

Banking in the USA at an inflection point

Three trends that have been building up for the past 5-7 years are coming to a head in US banking with the advent of Covid-19. These have created an inflection point in banking in the USA.

Social Media, Life Insurance and Behavioral Science

Startups are taking the life insurance industry by storm. Many acquire a substantial portion of their customers on social media. We dive into what this strategy and the use of micro targeted marketing means in life insurance more broadly.

What every Banker wishes FinTechs knew about risk management

Banks and FinTech companies often struggle to work together. Why? More than anything because most FinTech companies don’t understand the business of risk management. Here’s an overview of what bankers want fintech firms to know in order to work with them.

Fintech: the revolution delayed

The ‘fintech revolution’ has been delayed for nearly a decade. Collaboration between banks and fintech firms has been hard to achieve, for a variety of reasons outlined in this article. But changes in the industry since 2017 have made it easier for banks to work with fintech, making innovation in banking more likely than before.