The Rise of Quantum Computing and Implications for Financial Services

Notes From Avinash: A fascination with quantum mechanics

At a personal level, I have had a long-held and deep interest and fascination with quantum mechanics. A fascination that subatomic particles displayed unique tendencies and behaviors that differed from their larger-scale counterparts under the influence of Newtonian mechanics and Relativity. What, however, was fascinating for me was that subatomic particles could exist simultaneously in dual states i.e. displaying the properties of both a wave and particle at the same time. We have witnessed a similar manifestation in the quantum computing world. While the basic unit of information in the classical computing world is binary in the form of a ‘bit’, data in the quantum world can exist as a quantum bit (qubit), a state of ‘superposition’ in which both states of information can exist simultaneously with varying probabilities. This gives quantum computers the computational ability to process complex mathematical operations, particularly those requiring exponential applications, more efficiently and in a much shorter time frame than their classical counterparts.

Investment into quantum computing

According to the latest McKinsey Quantum Technology Monitor, there has been significant momentum in Quantum Technology investment in recent years, with an increase in the number of start-ups, driving a peak in funding up to $2.35 billion in 2022, an increase in focus and allocation of resources within large companies and a growing number of use-cases in production. Four sectors are expected to experience the earliest impact from quantum computing in the next 5-10 years. These include chemicals, life sciences, finance and mobility collectively representing a $2 trillion opportunity by 2035. Financial services is expected to be the major beneficiary of between $400-$600 billion.

There are a number of challenges associated with commercializing quantum technology including, access to hardware and infrastructure. Success increasingly will depend on a collaborative and interdisciplinary approach that includes academia, corporates, investors, start-ups and governments to develop and industrialize the technology and address the talent gaps. Significant progress has also been made in Quantum Error Correction helping to close the gaps on large scale fault tolerant computing for qubit coherence and logic.

Opportunities for the financial sector

Quantum computing could have a disruptive impact on many fronts in the financial sector, particularly in use cases leveraging cryptography, optimization, AI, and unstructured data. Financial sector players that leverage their capability could develop a significant competitive advantage. In fact, wherever large volumes of data exist, the application of algorithms to calculate probabilistic outcomes at speed could be beneficial. It would be able to:

Process large volumes of unstructured data improving insights and identifying non-linear relationships

Support real-time asset allocation decision-making on investment portfolios that are dependent on large volumes of market data that are often cluttered by noise

Help with real-time risk decision support including running simulations and stress tests and increasing the accuracy of risk pricing

Deliver quick wins in areas where AI has already been implemented by increasing computational speed and the ability to process live stream data

Risks associated with cryptography and the threat timeline

The rise of quantum computing is also accompanied by significant risks, particularly the implications for cybersecurity. Cryptographic protocols currently used in banks and payment systems rely on constraints in classical computing to perform prime factorization of large numbers. Quantum computers, however, do not face this constraint and can leverage their computing power to decrypt these protocols using Shor’s algorithm. A new type of quantum encryption will be required to safeguard banking systems and, thus, data from unauthorized access.

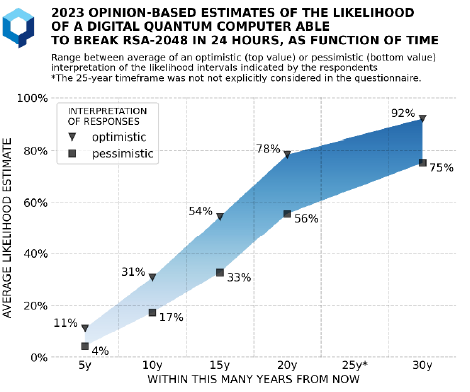

The Global Risk Institute has been producing an annual Quantum Threat Timeline Report to estimate the likelihood of the emergence of a Cryptographically Relevant Quantum Computer (CRQC) that could pose a cybersecurity risk. The estimates are based on the views and opinions of 37 leading global experts and are expressed as a range between pessimistic and optimistic likelihoods over the next 30 years. The data reveals an optimistic likelihood of 11% in year 5, increasing thereafter to 31% in year 10 and 54% in year 15. The likelihoods have also progressively increased for the same time frames when compared to previous surveys indicating a maturation of the technology.

What steps can financial institutions take?

Include monitoring of quantum computing developments in your PESTLED analysis and strategic planning processes - understanding the trajectory of investments and development in hardware, software, systems, applications, services as well as the implementation and success of use cases in production can help organizations define their strategic posture, risk appetite and responses

Monitor and connect with quantum ecosystems developing in territories of operation - collaborating with academia, government, start-ups will help the organization stay at the forefront of technological developments and identify partnerships opportunities to accelerate strategy

Integrate quantum computing into the risk management framework of the organization - this should be led by the strategy of the organization. However integration into existing risk types including technology, cyber, operational resilience and data should be immediate considerations. The implications and impact of quantum computing on existing risks should be considered in risk policy, risk appetite, risk responses and monitoring

Acquire, grow and develop quantum computing talent - there is currently a geographical misalignment between where talent is being produced and where demand lies, leading to scarcity. Organizations need to align their talent management strategies with their corporate and business strategies.

Maintain a proactive and open engagement with regulators - financial sector regulators have developed a pro-innovation stance over recent years due to the emergence of new technologies including AI. This has included a balanced and consultative approach to risk identification and development of guidelines and it will serve financial institutions well to reciprocate through openness and transparency. As an example, earlier this year the Office of the Superintendent of Financial Institutions (OSFI) in Canada published an OSFI-FCAC questionnaire with a focus on AI and quantum computing to gather industry information on cyber strategy and readiness to deal with quantum threats.

Quantum computing is an evolving and maturing field and so is the underlying technology and its capability. We will keep a close watch on these developments and continue sharing our views and perspectives on them and their implications for financial institutions.

Best regards,

Risk and Compliance Partner