Articles:

The Next Waves in US Banking - Part 3: Using BaaS to Issue Credit Cards

An area that can be particularly challenging for smaller banks is the issuance of credit cards, both consumer and business. Embedded finance has created new options in this area for smaller banks, allowing them to leverage what has been termed “Credit Cards as a Service” (CCaaS). This article, the 3rd and final in our series on Embedded Finance, gives an example of how this can work.

How Big Tech threatens banking

Big Tech firms can do a wide range of things that traditional banks find very difficult to do cost-effectively. Digital-only banks have had relatively limited success so far, partly because they have to build market reach incrementally, even when they are sponsored by a well-known commercial bank. Big Tech companies, like Google, Facebook, Amazon, Apple and Ant Group, have massive ready-made customer bases – both consumers and businesses – who are ripe for the digital finance picking.

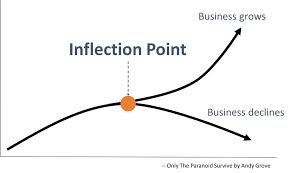

Banking in the USA at an inflection point

Three trends that have been building up for the past 5-7 years are coming to a head in US banking with the advent of Covid-19. These have created an inflection point in banking in the USA.